We Value Your Privacy

We use cookies and similar technologies to enhance your browsing experience, analyze site traffic, and personalize content. By clicking “Accept All,” you consent to the use of all cookies. You can manage your preferences or learn more by clicking “Settings.”For detailed information, please review ourPrivacy Policy.

Not connected

Build with Asvoria.app — Launch Smarter, Faster!

Instantly create stunning AI-powered web apps and games for your next big project on Asvoria.app. No coding. No waiting. Just launch.

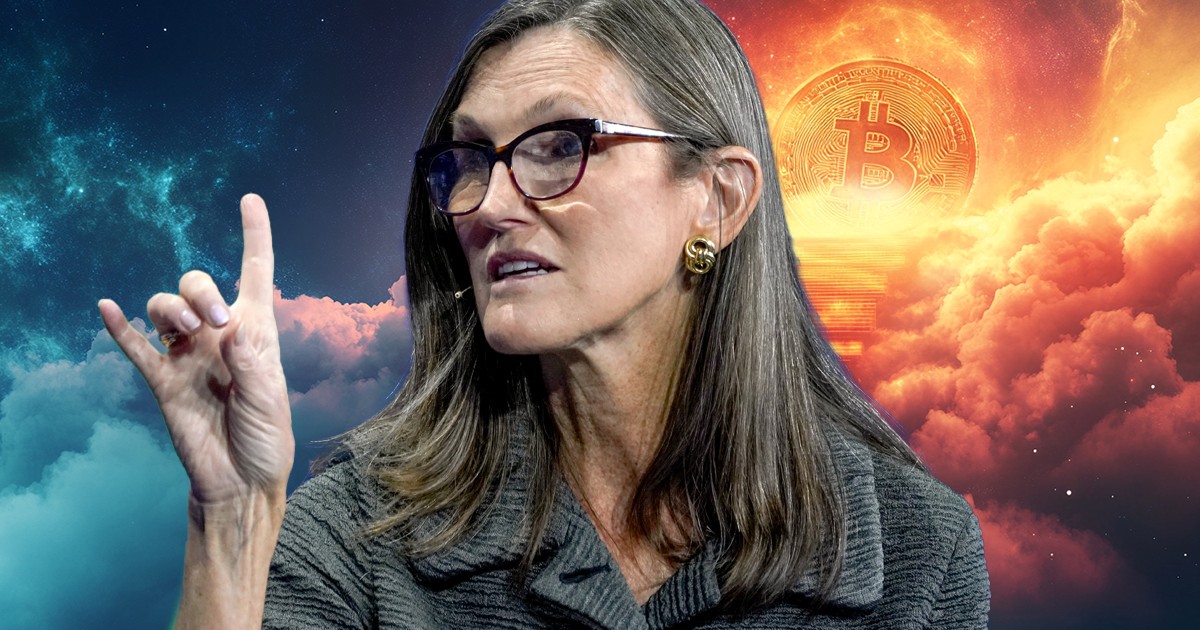

Cathie Wood Says Bitcoin's Going to $1.5M

February 13, 2025 at 10:19 AMby The Block Whisperer

+34

+0

Cathie Wood predicts $1.5M Bitcoin, citing Wall Street adoption, stablecoin dominance, and DeFi growth. Finance is changing, and Bitcoin's role is bigger than ever.

Web3 insights in your social media feed

Crypto's favorite optimist is back with another spicy prediction, and this time, it has seven figures.

Cathie Wood just doubled down on Bitcoin's future, claiming its chances of hitting $1.5M are better than ever.

And before you roll your eyes, hear her out – she might be onto something this time.

Big Gap To Jump

Bitcoin's currently chilling below $100K (yeah… again…)

But Wood's target entails a casual 1,450% pump from here.

Sure, it sounds wild, but remember when people thought $100k was impossible?

That wasn’t all that long ago, and if history is any precedent, what seemed impossible yesterday is the reality of today.

Why She's So Bullish

Wall Street is finally showing up at the Bitcoin party.

The same suits who called crypto a scam are now quietly adding it to their portfolios.

It’s the classic tale of “watch what they do, not what they say” – it turns out a lot of these firms have been stacking sats, or at least preparing to do so, for longer than many thought possible.

But the real story might actually be in stablecoins, which just processed $15 trillion in transactions last year.

That's more than Visa and Mastercard combined, and by year-end, they’re on track to hit $30 trillion by end of 2025.

Let that sink in – digital dollars are moving more money than the plastic cards in your wallet.

We’re officially living through a quiet revolution in the way money moves around the world – while a lot of us are waiting for bags to pump, an entire population is shuffling digital dollars across borders.

DeFi Isn’t Just a Buzzword Anymore

Wood is particularly excited about DeFi – that thing your yield-crazed friend won't shut up about.

It turns out the decentralized side of finance is growing like a weed and reaching maturity levels that have even the most ardent Wall Street TradFi diehard giving it the side eye.

It makes sense – just a few years ago, DeFi was a niche experiment that could barely command a few billion in total value locked.

DeFi summer changed all that, and now, five years on, it's moving billions of dollars daily with an efficiency that traditional financial rails can’t possibly compete with.

Zooming Out

Traditional finance is changing whether it likes it or not.

Bitcoin isn’t just magic internet money anymore – it's becoming part of the global financial system.

Banks are buying it, politicians are talking about it, and, more than likely, your parents are once again asking you about it.

$1.5M Bitcoin might sound a bit crazy, but it’s certainly not impossible.

Five years ago, $100k Bitcoin sounded insane, too, and look where we are now… still below $100K, but we’ve been there before.

Wood might be early with her prediction, but she's spotted something important: the game is changing.

The big question now isn’t whether Bitcoin hits $1.5M or not – it’s in this newly changed game, who are the new big players and what are their plans for our industry?

Explore more articles like this

Subscribe to Asvoria News to receive all the latest news.

Stay ahead with exclusive press releases and expert insights on Web3 and the Spatial Web. Be the first to hear about Asvoria’s latest innovations, events, and updates. Join us — subscribe today!

Editor’s choice

- BlackRock’s iBIT ETF Hits 100 Billion Dollars in Assets Amid Institutional Crypto Surge

- Crypto Carnage: $102K Bitcoin Flash Crash and SUI’s 87% Plunge as Tariff Shock Triggers Record Liquidations

- S and P Introduces Digital Markets 50 Index Blending Crypto and Stocks

- Major Global Banks Explore Issuing Stablecoins Pegged to G7 Currencies

- Tensions Between U.S. Senators Stall Crypto Regulation Bill

© 2025 Asvoria. All rights reserved.

Avoria does not endorse or promote investment in any of the tokens or NFT projects featured on this platform.

We accept no responsibility for any losses incurred. Users should conduct their own research and consult with a financial advisor before investing.

For more information about Doing Your Own Research (DYOR), please visit this link.