We Value Your Privacy

We use cookies and similar technologies to enhance your browsing experience, analyze site traffic, and personalize content. By clicking “Accept All,” you consent to the use of all cookies. You can manage your preferences or learn more by clicking “Settings.”For detailed information, please review ourPrivacy Policy.

Not connected

Build with Asvoria.app — Launch Smarter, Faster!

Instantly create stunning AI-powered web apps and games for your next big project on Asvoria.app. No coding. No waiting. Just launch.

Saylor Just Pitched an $81T Bitcoin Plan to the SEC To Solve The National Debt

February 26, 2025 at 6:20 PMby The Block Whisperer

+50

+0

Saylor pitches SEC on $81 trillion Bitcoin strategy for US Treasury, claiming it could eliminate national debt while establishing economic dominance.

Web3 insights in your social media feed

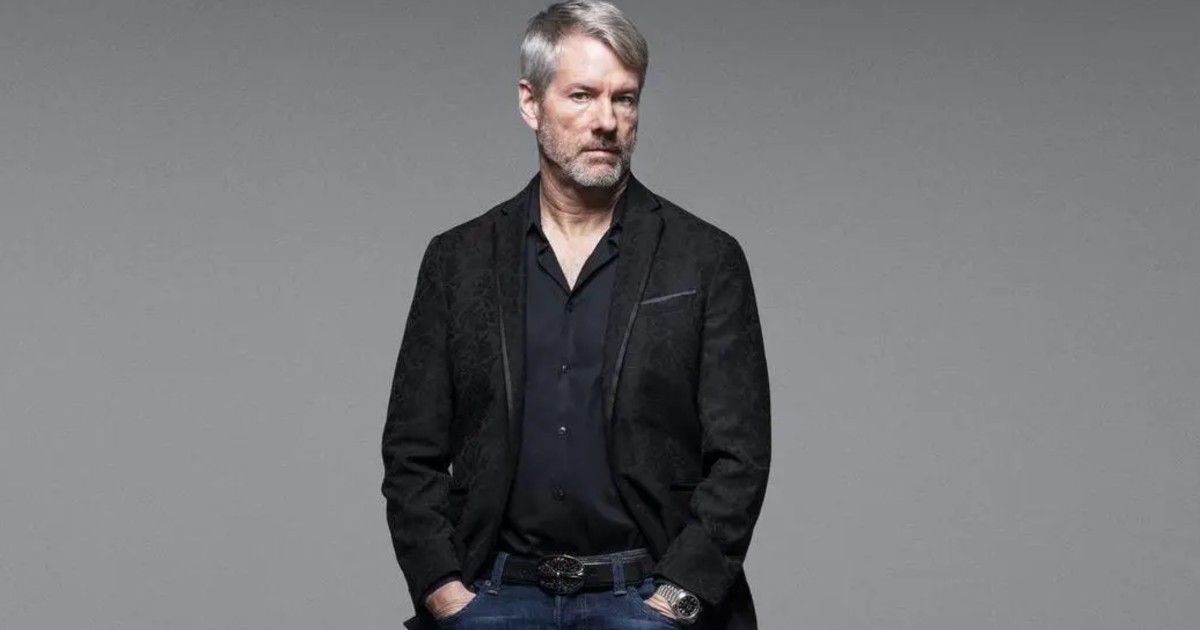

Michael Saylor is going for broke with his latest Bitcoin moonshot.

The Strategy chairman just told the SEC they could generate $81 trillion by stacking sats at the Treasury.

And he’s not just opining on what could be – the guy actually got a meeting with the SEC's Crypto Task Force to pitch the concept on Friday.

The Master Plan

Saylor's proposal is about as subtle as a sledgehammer, entailing that America builds a strategic Bitcoin reserve that could generate between $16-81 trillion in wealth.

The big selling point is that it could wipe out the entire $36.2 trillion national debt and still have cash left over for a sizable shopping spree.

His vision includes expanding the digital currency market to $10 trillion and growing the broader digital capital market to a staggering $280 trillion.

It's not a small proposal, but America has done crazier things in the past.

Six-Part Framework

Saylor has clearly put some deep thought into this plan as well, as it’s equally meticulous as it is bold.

It's part of his "Digital Assets Framework" that he's been pushing since December and entails a framework that orts crypto into six neat boxes:

- digital commodities (Bitcoin)

- securities (tokenized stocks)

- currencies (stablecoins)

- utility tokens

- NFTs

- asset-backed tokens

Not a bad spread.

He also wants to cap compliance costs at 1% of assets under management – something every crypto founder would no doubt toast to.

New SEC, New Potential Acceptance?

The fact that the SEC even took this meeting shows how much things have changed.

Hester Peirce, also known as “Crypto Mom,” is taking a bold new approach to the industry – she’s actually talking to industry players instead of just suing them.

This marks a complete 180 from the SEC's previous "regulate by enforcement" approach that ultimately had a chilling effect on innovation in the United States for the last half a decade.

Saylor isn't just pitching this as good for Bitcoin but wrapping it in the American flag.

Last week, he suggested the US government should buy up 20% of all Bitcoin to maintain global economic dominance.

He's positioning Bitcoin as protection against the money printer and arguing that a national Bitcoin reserve would actually strengthen the dollar, not replace it.

This is the kind of 4D chess argument that might actually work in Washington – talk to talk to get them to walk the walk.

Putting Money To Mouth

While others talk, Saylor keeps buying.

Strategy just raised another $2 billion to add to their Bitcoin stack, proving Saylor is betting his entire legacy on this vision.

The company now holds nearly 500,000 BTC, making it a larger Bitcoin holder than most countries.

When Saylor presents to the SEC, he's not just some random crypto bro – he's backed by a Nasdaq-listed company with billions on the line.

A Man With A Vision

Saylor's $81 trillion vision might sound crazy today, but so did his initial Bitcoin purchases back when everyone called him insane.

If even a fraction of his proposal gains traction, the implications for Bitcoin's price and the entire crypto industry would be seismic.

Central bankers are probably watching this unfold with a mixture of curiosity and existential dread.

Explore more articles like this

Subscribe to Asvoria News to receive all the latest news.

Stay ahead with exclusive press releases and expert insights on Web3 and the Spatial Web. Be the first to hear about Asvoria’s latest innovations, events, and updates. Join us — subscribe today!

Editor’s choice

- S and P Introduces Digital Markets 50 Index Blending Crypto and Stocks

- Crypto Carnage: $102K Bitcoin Flash Crash and SUI’s 87% Plunge as Tariff Shock Triggers Record Liquidations

- BlackRock’s iBIT ETF Hits 100 Billion Dollars in Assets Amid Institutional Crypto Surge

- Tensions Between U.S. Senators Stall Crypto Regulation Bill

- Major Global Banks Explore Issuing Stablecoins Pegged to G7 Currencies

© 2025 Asvoria. All rights reserved.

Avoria does not endorse or promote investment in any of the tokens or NFT projects featured on this platform.

We accept no responsibility for any losses incurred. Users should conduct their own research and consult with a financial advisor before investing.

For more information about Doing Your Own Research (DYOR), please visit this link.