We Value Your Privacy

We use cookies and similar technologies to enhance your browsing experience, analyze site traffic, and personalize content. By clicking “Accept All,” you consent to the use of all cookies. You can manage your preferences or learn more by clicking “Settings.”For detailed information, please review ourPrivacy Policy.

Not connected

Build with Asvoria.app — Launch Smarter, Faster!

Instantly create stunning AI-powered web apps and games for your next big project on Asvoria.app. No coding. No waiting. Just launch.

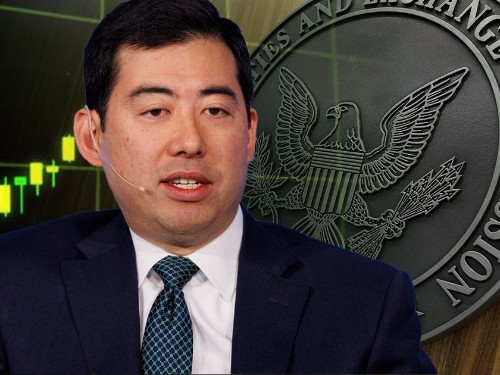

Trump Picks Uyeda to Lead SEC in Agency’s Crypto Makeover

January 21, 2025 at 9:16 AMby The Block Whisperer

+50

+0

Trump appoints Mark Uyeda as SEC acting chair, replacing Gensler, signaling a pro-crypto shift. Clear rules, innovation support, and reduced enforcement are expected.

Web3 insights in your social media feed

We’re seeing changes across the board – not least within the halls of the United States Security Exchange Commission (SEC).

Donald Trump named Mark Uyeda acting SEC chair right after taking office, pushing out Gary Gensler and signaling a massive shift in crypto regulation for the country.

With Trump and his wife, Melania, having both recently launch meme coins, the precedents he’s setting are bound to have far-reaching effects for the industry,

Fresh Face, Fresh Take

Uyeda's not new to crypto fights – he's been vocal about the SEC's mess under Gensler, calling the current crypto market rules "untenable."

Working with Hester Peirce, he's been pushing for clearer rules instead of enforcement actions.

Gensler’s term was marked by record-breaking lawsuits and enforcement actions, signaling a clear split between pro-crypto and anti-blockchain personnel in Washington.

Trump is Cleaning House

The big shift towards the former is already starting.

Word is Uyeda's team is reviewing old enforcement cases and scrapping the "regulation by enforcement" playbook entirely.

Instead of swinging the hammer first, they're talking about writing clear rules everyone can follow.

Once those are in place, the sky’s the limit for innovation in the US.

The Bigger Regulatory Picture

Trump’s pro-crypto appointments go well beyond just the SEC.

The new commander in chief also tapped Paul Atkins for permanent SEC chair through 2026.

While he needs Senate approval, Atkins brings serious crypto credentials to the table.

Over at the FDIC, Travis Hill is taking charge, ready to help banks work with crypto companies rather than debanking pro-crypto entities.

Unprecedented Changes on the Hill

Under Gensler’s SEC, cypto companies had a hard time doing pretty much anything without getting sued.

Uyeda's promising something entirely different. Clear rules, fair play, and room for innovation with blockchain and in the Web3 space.

For an industry begging for clarity, this is huge.

Keep an eye out for an massive regulatory shift that’s coming down the pipe – the SEC is just setting the table for a regulatory clarity feast.

Banks might finally get green lights for crypto. Projects could get guidance before getting subpoenas. Innovation might actually get a chance.

And it’s about time.

A New Leaf for Everyone

The crypto market is already responding positively, but it’s like that the real changes, and price movements, are just starting.

Between Uyeda's temporary leadership and Atkins waiting in the wings, we're looking at months of potential pro-crypto policies.

It might seem like Trump is just playing nice with crypto to pander to his base, but these systemic moves all point towards a calculated move to reshape how America handles digital assets.

By putting Uyeda in charge now and Atkins shortly thereafter, they're setting up long-term change, not just quick fixes.

For an industry that's been fighting regulators for years, this is a breath of fresh air. One without enforcement action and subpoenas.

When the SEC chair talks about making crypto work instead of shutting it down, everyone pays attention.

The next few months could rewrite crypto's rules in America.

Between Trump's support and new leadership at key agencies, the game's changing. The question is no loner when regulation comes – it's now about what kind, and who it impacts.

Explore more articles like this

Subscribe to Asvoria News to receive all the latest news.

Stay ahead with exclusive press releases and expert insights on Web3 and the Spatial Web. Be the first to hear about Asvoria’s latest innovations, events, and updates. Join us — subscribe today!

Editor’s choice

- BlackRock’s iBIT ETF Hits 100 Billion Dollars in Assets Amid Institutional Crypto Surge

- Major Global Banks Explore Issuing Stablecoins Pegged to G7 Currencies

- Crypto Carnage: $102K Bitcoin Flash Crash and SUI’s 87% Plunge as Tariff Shock Triggers Record Liquidations

- S and P Introduces Digital Markets 50 Index Blending Crypto and Stocks

- Tensions Between U.S. Senators Stall Crypto Regulation Bill

© 2025 Asvoria. All rights reserved.

Avoria does not endorse or promote investment in any of the tokens or NFT projects featured on this platform.

We accept no responsibility for any losses incurred. Users should conduct their own research and consult with a financial advisor before investing.

For more information about Doing Your Own Research (DYOR), please visit this link.